We believe accountability and modesty are among the keys to success in this business. In striving for those qualities, LPL Research has a tradition of starting off a new year with a lessons learned commentary. We got some things wrong last year, no doubt. But those who don’t learn from their mistakes are doomed to repeat them. Here are some of our lessons learned from 2022. As you might imagine, inflation and the Federal Reserve are common themes throughout.

Lessons learned: Economic forecasts

The Fed’s bark was as bad as its bite!

Investors have been carefully dissecting Federal Reserve (Fed) officials’ words for decades, and depending on the composition of the Federal Open Market Committee (FOMC), its bark is often worse than its bite. But this time was probably different. One of the lessons learned in 2022 was to never underestimate our central bank’s resolve to squelch inflation. Another corresponding teachable moment was never overestimate the speed of price declines.

At the start of 2022, markets expected the upper bound of the fed funds rate to stay below 1%. The expectation was predicated on the view that inflation pressures would ease as global economies recalibrated to a post-pandemic environment. But inflation was stickier than anyone anticipated, and the inflation dynamics were further exacerbated by Russia’s invasion of Ukraine and COVID-19-related lockdowns in China. As inflation accelerated in early 2022, especially housing prices, members of the FOMC started warning investors about the need for aggressive action to fight inflation.

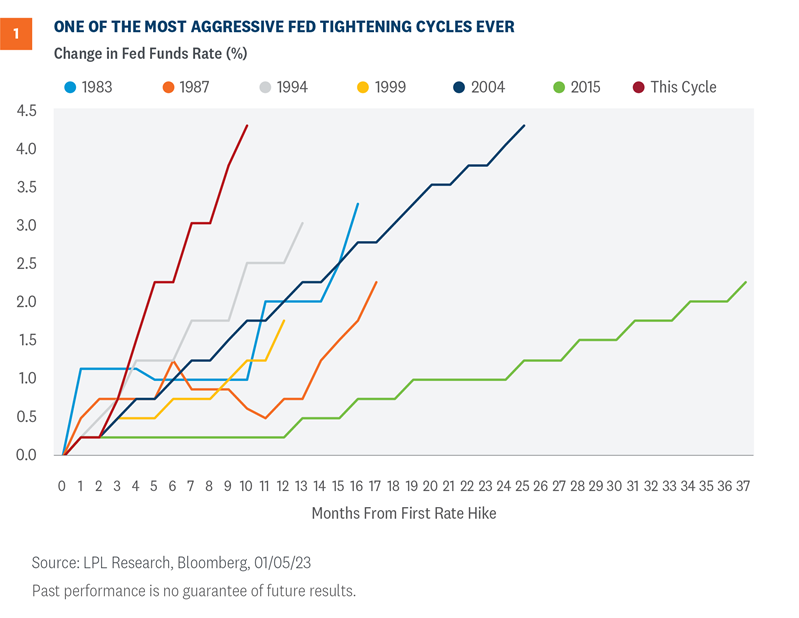

As shown in Figure 1, policy response was as aggressive as policymakers’ speeches. Policy makers were more intent on tightening financial conditions than virtually anyone anticipated. Investors have never seen four consecutive 75 basis point (0.75%) rate increases by the FOMC since the Fed started explicitly targeting the fed funds rate to implement monetary policy.

These lessons learned from 2022 are particularly important for 2023 since FOMC members expect rates in 12 months to be higher than what investors are currently expecting. Caveat emptor.

Lessons learned: Equity Market forecasts

Stock market impact from gradual hikes is very different than impact from steep hikes

Entering 2022, the LPL Research team agreed with the Fed that there was a path to a soft landing, despite high inflation. A soft landing is still possible at this point, but the path has narrowed a lot over the past six months or so given the aggressive Fed response to last year’s inflation surge.

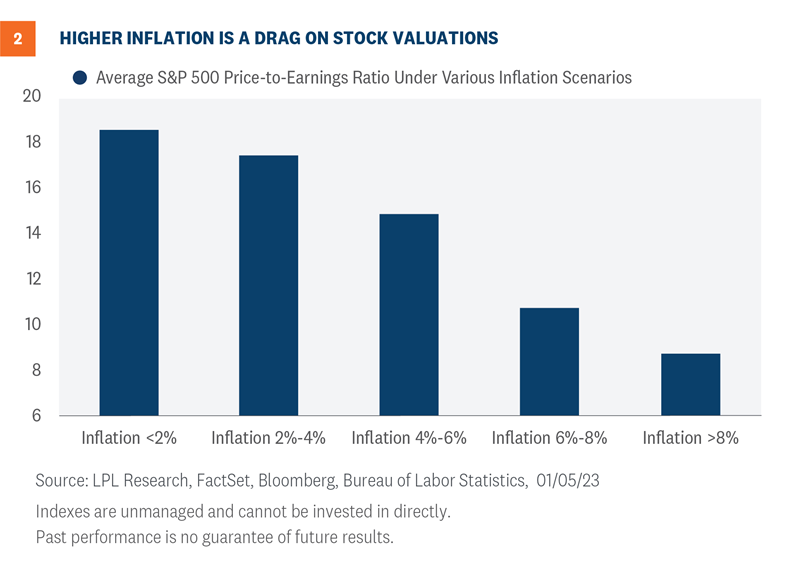

When LPL Research released the Outlook 2022: Passing the Baton in December 2021, the team’s view was that the hit from inflation would be manageable and would therefore limit the number and magnitude of interest rate increases, enable the U.S. economy to avoid recession, and support above-average valuations. Well, the hit from inflation was worse than we anticipated, the Fed was surprisingly aggressive (central bankers were clearly too slow in recognizing the severity of the inflation problem), and interest rates spiked well above our initial forecast. The relationship between inflation and stock valuations is a strong one, as shown in Figure 2, which meant the market could no longer support price-to-earnings (P/E) ratios over 20 (the same goes for the relationship between interest rates and stock valuations). The hit to valuations in the form of about 4 P/E points (21 to 17) translates into a roughly 20% drop in the S&P 500 Index.

While our team underestimated inflation and the resulting hit to valuations last year, there were some wins. LPL Research’s $220 S&P 500 earnings per share forecast at the start of the year looks spot on—consensus is now calling for $220.30 for 2022, with the fourth quarter yet to be reported. And on the asset allocation side, the team’s preference for value stocks throughout the year turned out to be a win.

Lessons learned: Bond Market forecasts

Relying on history doesn’t always work

Coming into 2022, we had the expectation that interest rates would rise from very low levels, but we thought the rise in rates would be gradual. At the start of the year, we assumed the Fed would take a gradual approach to removing the very accommodative monetary policy that had been in place, frankly, since the end of the global financial crisis. The reason? The last few rate hiking campaigns were very slow and deliberate. If you look back at the rate hiking campaign that began in 2015, for example, the Fed raised interest rates by 0.25% in December 2015 and didn’t hike rates again until December 2016. Moreover, if you look at the rate hiking campaign that began in 2004, the Fed didn’t actually get to its terminal rate until 2006—a full two years after it started. However, what transpired over the course of 2022 turned out to be the most aggressive rate hiking campaign in four decades.

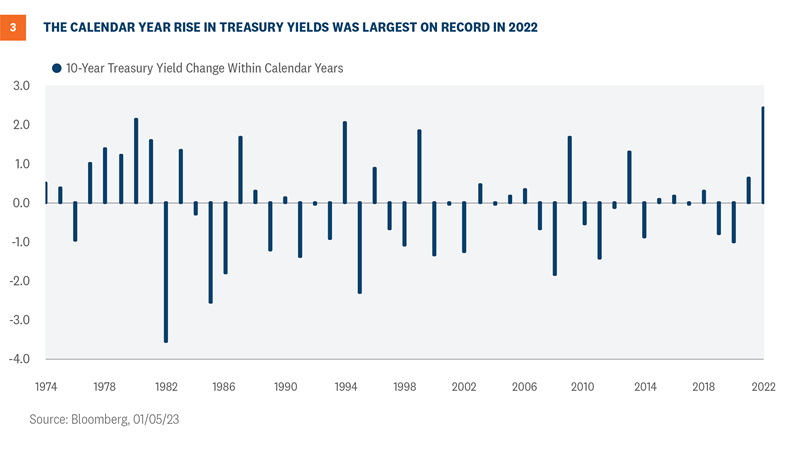

Because of that aggressive rate hiking campaign that took place largely in one calendar year, we saw Treasury yields increase the most in one calendar year on record. The chart below shows the changes in the 10-year Treasury yield on a calendar basis and the 2.4% increase in yield last year was more than any calendar year period on record; even during the 1970s and 1980s when interest rates were significantly higher than today. That upward pressure on yields certainly caused fixed rate coupon paying bonds to sell off dramatically last year, resulting in the worst year on record for core bonds (as measured by the Bloomberg Aggregate Bond Index).

Conclusion

LPL Research had some hits and misses in 2022, no doubt. As always, we try to learn from the misses while still recognizing the hits. After underestimating the inflation surge last year, the Fed and markets may be erring on the other side this year. The forces now pushing down on inflation are getting stronger, which may keep interest rates down and stock valuations supported this year. Here’s hoping for more hits and fewer misses for all of us in 2023.

Jeffrey Buchbinder, CFA, Chief Equity Strategist, LPL Financial

Lawrence Gillum, CFA, Fixed Income Strategist, LPL Financial

Jeffrey Roach, PhD, Chief Economist, LPL Financial

You may also be interested in:

- 2023 Market Outlook: LPL Research Takes a Look at the Year Ahead – January 3, 2023

- Historic Year for Central Bank Activity and Rate Hikes – December 19, 2022

- December Down but Not Out: Seasonality Trends Point to Market Recovery – December 12, 2022

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from Bloomberg.

For a list of descriptions of the indexes and economic terms referenced in this publication, please visit our website at lplresearch.com/definitions.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered inv estment advisor and broker -dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment a dvice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

RES-1379276-1222 | For Public Use | Tracking #1-05354821 (Exp. 01/24)